PERSONAL BANKING

High-Yield Savings

Boost your savings with our free high-interest savings account.

Earn One of the Best Rates in the Country

High-Yield Savings

High-Interest Earning

Earn 5.00% APY on your entire balance1

Freedom From Fees

No monthly service fees

No minimum balance requirement after $100 to open

Free ATM card available

To Apply Online, You’ll Need:

Your Social Security Number

$100 or more to open – you can use a debit card or transfer from an existing bank account

Let’s get started!

Don’t have a LendingClub account yet? Apply in minutes! What are you waiting for?

Account Features

Online & Mobile Banking

Free ATM Card

No Minimum Balance Requirement

At LendingClub, we put our customers at the center of everything we do. That’s why we focus on providing products and services that are not only convenient but help to make life easier.

You can apply online for a checking account, savings account, or CD by heading to our Personal Banking page. From there, select the account you’re interested in and click “Learn More.” After going to the product page of the account you are interested in, click on “Apply Online” to start filling out the application. Then, enter your personal information, verify your information, review and agree to disclosures, and fund your account. You will receive confirmation at the end of the application if your account has been approved. If not, you will receive an email notification.

To open an account, you need to be a citizen or resident of the United States.

Please have the following information available when you begin your application:

Your Social Security number

Your current residential address

Your email address

Your account number or debit card from another financial institution to make your opening deposit into your new High-Yield Savings account

You will need to fund the account with a minimum of $100.00

You can apply for and open a personal bank account entirely online in under 3 minutes, start to finish.

To complete the account opening process, $100 minimum opening deposit is required. You can add additional funds to your account at a later time by signing into online banking and setting up a funds transfer.

To make your initial deposit, you can transfer money from your account at another financial institution using your account and routing number or by using your debit card. Please ensure that you have sufficient funds available to be transferred. Your initial deposit may be held for 5

business days after receipt of the funds.

LendingClub does not pull credit as part of our account opening process. However, we do obtain information from a credit bureau used to validate your personal information. The request for information does not affect your credit score.

There is no monthly maintenance fee for a High-Yield Savings account. Additionally, we do not charge a fee to wire funds into your account from another bank, nor do we charge any overdraft fees. To see miscellaneous fees that may be applicable to your account, please click here.

There is no monthly minimum balance requirement for your High-Yield Savings account.

You can only apply for an account if you are 18 or older. You must also be a citizen or resident of the United States.

Yes! To open a joint account, you will check the “I want to make this a joint account” box on the Basic Info page of the application. You’ll need the same information that’s needed when opening an individual account, but you’ll need it for both applicants. You can also make a single account a joint account after the account is opened by contacting Customer Service.

We are currently only accepting online applications at this time. Click here to apply.

To add beneficiaries, please reach out to Customer Service at 800-242-0272 or use Secure Message within online banking.

You are able to deposit cash at any MoneyPass Deposit Taking ATMs.

There is no minimum balance required to earn interest in your High-Yield Savings account.

We use the daily balance method to calculate the interest on your account. This method applies a daily periodic rate to the principal in the account each day. Tiered rate accounts earn interest on the entire account balance each day at the interest rate and annual percentage yield in effect for the appropriate balance tier. Accrued interest is credited to the balance in the account on the last business day of the statement cycle. We use a monthly statement cycle. Accrued interest that is credited to the balance in the account begins to earn interest no later than the next business day and compounds with each statement cycle

Rates are variable and they are subject to change at our discretion.

Funds can be added to your account after account opening through mobile deposit available within our banking app, at select ATMs, or by initiating ACH transfers and Wires within online banking. Please see limits here.

To view your daily transaction limits, click here.

Rates are earned based on the balance in your account. If your balance changes, your rate may also change. It is also important to notice whether you are viewing the interest rate or the APY. These can differ slightly due to compounding. The APY is calculated by compounding the interest rate over the course of a year. The interest rate and APY are both disclosed in the Product Terms & Conditions which are available on the website and provided at the time of account opening.

The advertised rate is presented as an Annual Percentage Yield (APY), as required by regulation. The APY is the rate you can earn on your account over a year and includes compounded interest. The rate displayed in your online banking is the actual interest rate applied to your account. Your interest rate and APY are both disclosed in the Product Terms & Conditions which are available on the website and provided at the time of account opening.

Interest begins to accrue when the Bank actually receives the credit and deposits it into your account.

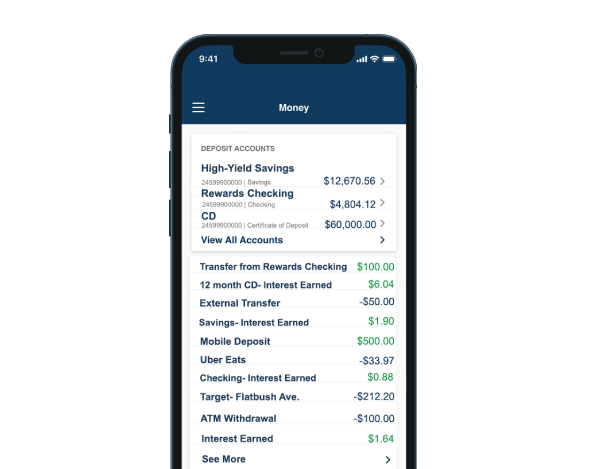

Online & Mobile Banking

Manage your accounts from anywhere with unlimited access – 24 hours a day, 7 days a week.